Welcome to Animated Finance Stories

We teach financial literacy through real stories showing how money truly works in our everyday life.

Let’s dive in—because financial literacy isn’t just taught, it’s lived.

Introduction

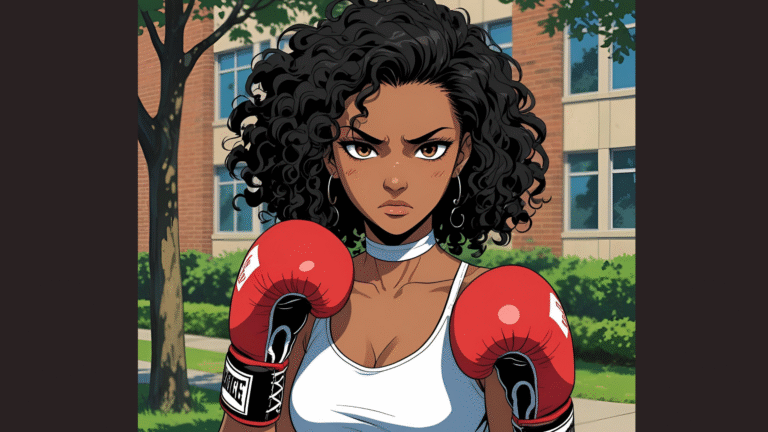

The scariest moment of my life was hearing my name called over the intercom: “Animonè, please come to the office, and bring your backpack” As I walked to the office, my heart pounded. I knew why I was in trouble, but I couldn’t break. I tried my best to show that I was not worried or showing any signs of cracking. My hands clenched into fists at my sides, and I took slow, measured breaths, hoping no one could see the storm raging inside me. But when I opened the door, and the two officers standing waiting for me, my whole face shattered!

I didn’t know it at the time, but this would be a turning point in my life. Here’s how I ended up in that moment.

Where It All Started

It’s 2005. My family and I were struggling—and I mean struggling. It was just me, my two sisters, and my mom crammed into a tiny one-bedroom apartment. Money was so tight that I had to sleep on a dollar-store pool float, hoping each night it wouldn’t spring a leak. As a single parent, my mom worked tirelessly at a low-wage job, selling insurance pushing through exhaustion to provide for us. Despite clocking in 40 hours a week, her paycheck barely stretched enough to cover our basic needs. Yet, through it all, she never let us feel the weight of her struggles, wrapping us in warmth, love, and resilience.

What My Mom Earned and How to Calculate Wages

In 2005, the minimum wage in California was around $6.75 per hour, but my mom earned $9.38 per hour. She worked 40 hours a week, so her weekly pay before taxes was:

- $9.38 per hour × 40 hours = $375 per week

Since there are 4 weeks in a month, her monthly pay before taxes (Gross Income) was:

- $375 per week × 4 weeks = $1,500 per month

Gross Income is the total amount of money earned by an individual or business before any deductions like taxes, Social Security, retirement contributions, or other withholdings.

My mom was not paid monthly—she was paid bi-weekly (every two weeks). So, instead of getting $1,500 all at once, my mom received two smaller paychecks of:

- $1,500 ÷ 2 = $750 per paycheck

But that was before taxes and before Uncle Sam took his cut. And you better believe he never missed a paycheck. Every time my mom got paid, he was first in line, taking his share before we could even put food on the table.

How Taxes Affected My Mom’s Paycheck & How to Calculate

Taxes were automatically taken out of each paycheck, which meant her take-home pay was much lower. Here’s an estimate of the taxes she paid and what the majority of Americans pay each month:

- Federal Income Tax (~10%) → About $150

- State Income Tax (~4%) → About $60

- Social Security Tax (6.2%) → About $93

- Medicare Tax (1.45%) → About $22

Total Monthly Taxes: $325

- Bi-Weekly Taxes: $325 ÷ 2 = $162.50 per paycheck

My mom paid $162.50 in taxes every two weeks. Taxes, of course, are meant to help build roads, fund schools, and support other public services. But when I looked at the schools in my area, streets, and services available, I couldn’t help but doubt that the taxes were being used for their intended purpose. The buildings were falling apart—hardly a reflection of the taxes we were contributing.

Nevertheless, that is a story for another day.

What My Mom Took Home After Taxes

After taxes, her bi-weekly paycheck was reduced even MORE:

- $750 – $162.50 = $587.50 per paycheck

So instead of bringing home $1,500 per month, my mom actually took home around $1,175 per month after taxes.

💡 Want to see how much taxes take from your paycheck? Use this Paycheck Calculator to estimate your own take-home pay!

Basic Needs, Big Costs: The Struggle of Monthly Expenses

Expenses are all the costs a family has to cover to live day-to-day. This includes things like housing, food, transportation, utilities, childcare, healthcare, and anything else the family needs to run their household.

For my mom, each of these expenses was another weight on her shoulders. Our rent, in comparison to today, wasn’t much, but for the amount we were living on, it took up more than half of my mom’s total monthly net income which was $1,175.

Net Income is the money you have left after deductions are taken out of your gross income. It’s the actual amount that goes into your pocket that can be either spent or saved.

These were our expenses:

- Rent: $750

- Utilities (electricity, water, gas, trash): $150

Remaining for groceries and other expenses: $1,175 – $750 – $150 = $275

With only $275 left for the entire month to cover groceries, clothing, transportation, and everything else, there wasn’t much room for anything extra.

Eating out, for example, wasn’t an option — most of our meals were homemade, even if it meant eating the same thing day after day. When it came to clothes, we relied on hand-me-downs from cousins or shopped at discount stores, only buying new items when absolutely necessary. Vacations were something we couldn’t afford either — while other families went on trips, ours usually meant staying home, making do with what we had. As for entertainment, it was always simple — a trip to the park or playing board games at home was as good as it got.

Every dollar had to be stretched as far as possible, and anything that wasn’t necessary had to be left out. This was a constant reminder that while others could enjoy these luxuries, we had to make do with what we had. These were tough times, but these tough times led me to think: How could I help my mom?

Turning Bargains into Business: The 99-Cent Store Opportunity

It was just another routine trip, nothing out of the ordinary—at least, that’s what I thought. After school, my mom took me to the 99-cent store, a place we visited often because it was affordable, especially when we were stretching the last of her paycheck before grocery shopping.

This time, though, she handed me $1 and told me I could spend it however I wanted.

“Hmmm,” I thought to myself. “Do I want to buy a toy? Nah, the last one I got broke the next day.”

What about an ice cream? But, no—last time it melted before I even made it to the car.

Or… what about some candy? Yes! That would be perfect!

I eagerly headed over to the candy aisle, scanning the shelves for my favorite candy, feeling like I was in candy heaven, ready to make the best choice of my day. Back then, before today’s inflation, $1 could actually go pretty far.

Inflation is the increase in the prices of goods and services over time, which causes the value of your money to decrease. Simply put, your money doesn’t go as far as it once did. For example, something that cost $1 in the past might cost $1.50 now due to inflation. This means you need more money to buy the same things, as the purchasing power of your dollar is reduced.

“Hmmm, which one do I want?” After a moment, I grabbed a pack of lollipops—16 for just 99 cents. I took one out of the pack just to marvel at delicious candy.

How could I resist?

I purchased the bag of lollipops and the rest of the day was pretty chill. I hung out with my family, snacking on lollipops, and enjoyed the simple moments. By the time I got home, I had finished my homework, still savoring the last of the candy preparing for school the next day.

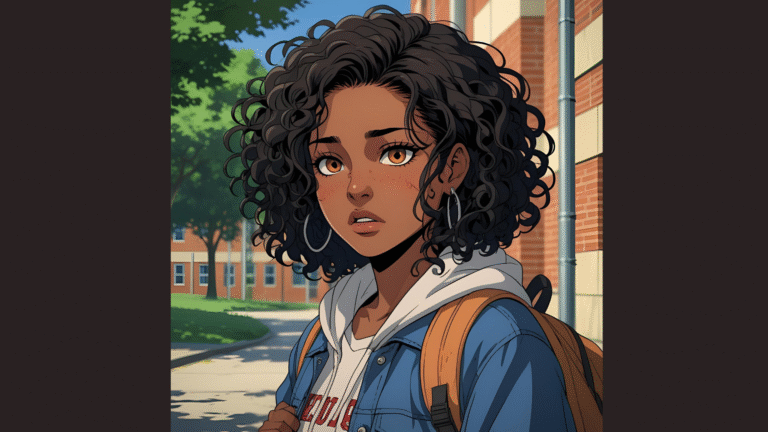

The Next Day

I walked into school with my backpack ready for another day. I was especially excited because I started off my morning with P.E., and there’s nothing better than kicking off the day with some fun. My friends and I hooped for an hour, laughing and clowning around. The whole vibe was energetic, and it felt good to start the day on such a high note.

Though, as soon as P.E. class ended, I headed to my second period class, and it was… History. It was just another mind-numbing hour of History—I found myself zoning out again. Let’s be real, how much of what we learn in middle school actually applies to real life? When’s the last time someone asked you about the American Revolution? Exactly.

My eyelids were getting heavier, and I was seconds away from dozing off when I suddenly remembered—I had lollipops in my backpack. That was enough to keep me going. I glanced around, making sure no one was watching, and carefully reached into my bag. Just as I peeled the wrapper off, a voice cut through my ears.

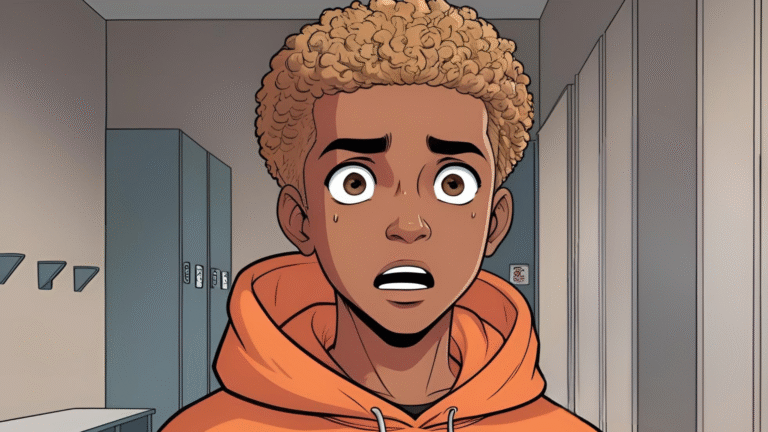

It was Gaskin.

Now, if there was one person who could make an already long class feel even longer, it was him. Snarky, nosy, and always inserting himself into other people’s business, he had an uncanny ability to get under everyone’s skin. And, of course, he had spotted the other lollipop sticking out of my bag.

“Yo, let me get that,” he whined, his eyes locked onto the candy like a hawk spotting prey.

“No.”

“C’mon, just one.”

“No.”

He kept begging. I kept shutting him down. It was a cycle at this point. But then, he said something I never expected to hear.

“Please, I’LL PAY YOU FOR ONE.”

The words hit me like a jolt of electricity. Gaskin? Offering to pay me? For a lollipop?

At first, I was just shocked. I mean, this was Gaskin—the same kid who never took anything seriously, the same kid who annoyed everyone just for fun. And now he was actually willing to hand over money for a piece of candy? That’s when it hit me. If Gaskin was desperate enough to pay for a lollipop, how many other kids would be willing to do the same?

I started doing the math in my head. A bag of lollipops cost $1. If I sold each one for a quarter, by only selling 4 I would make my money back! This could actually work. I wasn’t just some kid with candy—I was on my way to coming up with a great idea.

But just as I was about to work out how much I could make in a week, my teacher’s voice snapped me back to reality.

“Stop talking and pay attention!” she barked, her eyes locking onto me.

I sat up straight, nodding like I totally cared about whatever lesson she was droning on about. Gaskin did the same, trying to look innocent. The second she turned away, I leaned slightly toward him and whispered, “Give me a quarter.”

Without hesitation, he slid the coin into my hand under the desk. Smooth. I quickly stuffed it into my pocket and, just as discreetly, handed over the lollipop. Gaskin snatched it up, immediately unwrapping it like he had just won the lottery.

I leaned back, a smirk creeping onto my face, holding up my first ever made quarter. This was only the beginning of my first side hustle.

But little did I know, later that smirk would be soon wiped off my face as I would soon find out that I would be face to to face with police officers.

Want to know what happens next? [Click here: https://animatedfinance.org/the-side-hustle-that-almost-got-me-arrested-part-2/ to read Part 2!]

1 Comment